Tax time. It's been that time of year since it turned 1/1/10. If you're like me, you gather everything you need, put it in a pile, near/around your eyes' view and wait till almost the last moment. My reasoning is that I have everything I need, but the energy to get it done is just not there. But, I finally tackled it! Federal taxes can be scary, and I want to double check it before I send it in. So it's sitting again, waiting for the right moment.

I have been doing my own taxes since I was 18. It was easy enough and even though I am a right brainer, there is something about working with numbers within boxes that is kind of fulfilling. My dad taught me. He has also been doing his own taxes for decades! Doing taxes for a small business is a bit of a different ball game. Carlos and I have a Limited Liability Company (LLC) and I did my first set of taxes for it last year. It was overwhelming and I didn't want to do them again, to tell you the truth, but since time is money (and I have more time than money), I decided to take the plunge...again.

Let's talk about this. There are so many resources out there for small businesses, so we don't have to feel alone, scared and angry at our taxes! The first rule of thumb, which I am also still working on, is keeping your documents organized. I cannot stress enough how much easier it is to do your quarterly and yearly taxes when paperwork is organized. I get better at it every year. A filing cabinet is a MUST (or something like it).

What are quarterly taxes? Good question! You will only have to worry about that question if you meet any of the criteria below:

- Are engaged in business in California

- Intend to sell or lease tangible personal property that would ordinarily be subject to sales tax if sold at retail (this includes wholesalers, manufactures and retailers.)

- Will make sales for a temporary period, normally lasting no longer than 30 days at one or more locations (for example, fireworks booth, Christmas tree lots, garage sale)

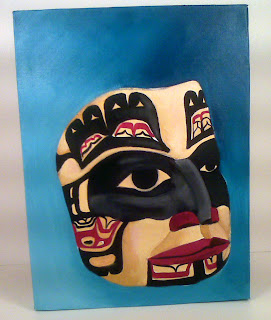

Please enjoy this mental break. Painting by Carlos Rodriguez.

The easiest thing to do, is to go into the Board of Equalization and sign up! Click the link and it will take you to a list of field offices in California. It's pretty quick, easy and FREE! I suggest going into the office to be familiar with the folks there and where it's at. At some point you're going to have to go there anyways...make friends with them now!

Okay...now on to the difficult stuff...Federal Taxes. Yikes! The first, and best, place to check out, before you even start is the IRS Small Business and Self Employment Tax Center. Don't be scared of the IRS, they are really here to help us out and they have given us A LOT of resources to make it less painful.

Here is one of THE BEST resources they offer. Whether you need a refresher, or new to small business tax, check out the small Business Tax Virtual Workshop! You can watch it at your own pace and watch what is relevant to you.

Mental break #2. Painting by Carlos Rodriguez.

Mental break #2. Painting by Carlos Rodriguez.He painted a series of mask paintings for a fund-raising event for the nonprofit he works for. Lucky bastards!

Now you know how to get started, let's look at a couple ways to keep those receipts in order!

First, Woman's Finance suggests creating a list of receipts and paperwork that you'll need to file your taxes. Then, create a filing system that you can easily organize and pull paperwork out quickly, if needed. You have many choices! Manila folders, accordion style file, or you can kick it old school and use shoe boxes. What ever works for you is what is best.

Next, start using a tabbing system that makes it easy to organize and sort your paperwork. Color or number coding is a good way to start. Martha Stewart suggests in order to keep the filing system going, set time aside to dedicate to organizing. Keeping a shredder around also helps in getting rid of clutter. Remember it takes 22 days to make something a habit.

Lastly, create categories to organize your files. The schedule C form (what is used to file small business Federal taxes), is a good place to start to look for categories. For my rule of thumb, one of the first categories I create is for the receipts for good that go into directly making our products. There are 19 deductions you can use if you run the business out of your home (which equals 19 categories, not all of which you will use as a beginning business person).

Some good places to look for good inexpensive organizers check out IKEA, Target, Goodwill, Savers and craigslist.

Good luck! Join me next week as I discuss life and business. Till then, keep your head high, think happy thoughts and love yourself.

**Do you have a business question you want answered? Email me!**

First, Woman's Finance suggests creating a list of receipts and paperwork that you'll need to file your taxes. Then, create a filing system that you can easily organize and pull paperwork out quickly, if needed. You have many choices! Manila folders, accordion style file, or you can kick it old school and use shoe boxes. What ever works for you is what is best.

Next, start using a tabbing system that makes it easy to organize and sort your paperwork. Color or number coding is a good way to start. Martha Stewart suggests in order to keep the filing system going, set time aside to dedicate to organizing. Keeping a shredder around also helps in getting rid of clutter. Remember it takes 22 days to make something a habit.

Lastly, create categories to organize your files. The schedule C form (what is used to file small business Federal taxes), is a good place to start to look for categories. For my rule of thumb, one of the first categories I create is for the receipts for good that go into directly making our products. There are 19 deductions you can use if you run the business out of your home (which equals 19 categories, not all of which you will use as a beginning business person).

Some good places to look for good inexpensive organizers check out IKEA, Target, Goodwill, Savers and craigslist.

Good luck! Join me next week as I discuss life and business. Till then, keep your head high, think happy thoughts and love yourself.

**Do you have a business question you want answered? Email me!**

1 comment:

I feel so savvy! Thanks for the great, informative post. (And I especially appreciated the "mental breaks" lol!)

Post a Comment